- Analisis

- Tinjauan pasar

Technology shares drag US market - 5.12.2017

Dow closes at record while Nasdaq, SP 500 slip

US broad stock market slipped on Monday as technology stocks sold off. The dollar strengthened: the live dollar index data show the ICE US Dollar index, a measure of the dollar’s strength against a basket of six rival currencies, rose 0.2% to 93.08. S&P 500 lost 0.1% settling at 2639.44. The Dow Jones industrial average meanwhile rose 0.2% to record high 24290.05. The Nasdaq composite index dropped 1.1% to 6775.37.

Treasury yields rose as Senate passed its tax overhaul bill early Saturday. The Senate version of the tax bill differs from the legislation passed by the House of Representatives and a final bill must then be approved by both the House and Senate before President Donald Trump can sign it into law. Economic news was negative: US factory orders fell 0.1% in October, less than expected, largely because of fewer orders for passenger planes and cars.

Bank stocks lead European markets rebound

European stocks further rebounded on Monday led by bank shares. Both the euro and British Pound fell against the dollar. The Stoxx Europe 600 index ended 0.9% higher. The DAX 30 jumped 1.5% to 13058.55. France’s CAC 40 rose 1.4% and UK’s FTSE 100 finished 0.5% higher at 7338.97. Indices opened mixed today.

Investors optimism was boosted by the passage of the tax overhaul bill by the US Senate early Saturday. Pound ended marginally higher despite a selloff after UK Prime Minister Theresa May failed to reach a Brexit deal with European Commission President Jean-Claude Juncker on the Irish border, EU citizens’ rights and the size of the UK’s “divorce” bill on Monday.

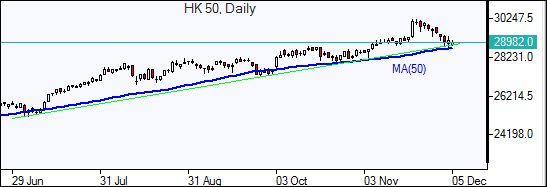

Technology stocks drag Asian markets

Asian stock indices are lower today dragged by technology stocks following their selloff on Wall Street overnight. Nikkei lost 0.4% to 22622.38 despite a weaker yen against the dollar. Chinese stocks are lower: the Shanghai Composite Index is 0.2% lower and Hong Kong’s Hang Seng Index is down 0.6%. Australia’s All Ordinaries Index is 0.2% lower as Australian dollar rebounded against the US dollar after better than expected retail sales report for October. As expected, the Reserve Bank of Australia did not make a change in interest rates.

Oil edges lower

Oil futures prices are inching lower today. Prices fell Monday as recent data showed US drillers added 2 more oil rigs last week. February Brent crude settled 2% lower at $62.45 a barrel on Monday.

Lihat juga