- Analisis

- Analisis teknis

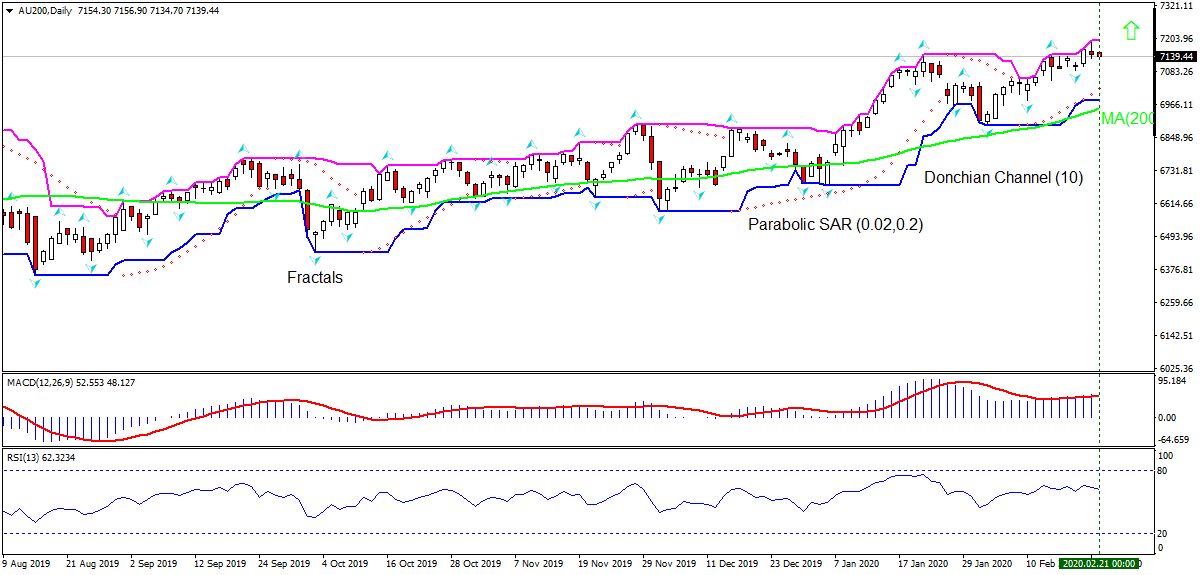

ASX 200 Analisis teknis - ASX 200 Jual beli: 2020-02-21

Indeks Bursa Efek Australia Technical Analysis Summary

Atas 7196.21

Buy Stop

Bawah 7089.01

Stop Loss

| Indicator | Signal |

| RSI | Neutral |

| MACD | Sell |

| Donchian Channel | Neutral |

| MA(200) | Buy |

| Fractals | Buy |

| Parabolic SAR | Buy |

Indeks Bursa Efek Australia Chart Analysis

Indeks Bursa Efek Australia Analisis Teknis

On the daily timeframe AU200: D1 has risen above 200-day moving average MA(200) which is rising. This is bullish. We believe the bullish momentum will continue after the price breaches above the upper Donchian boundary at 7196.21. This level can be used as an entry point for placing a pending order to buy. The stop loss can be placed below 7089.01. After placing the pending order the stop loss is to be moved every day to the next fractal low, following Parabolic signals. Thus, we are changing the expected profit/loss ratio to the breakeven point. If the price meets the stop-loss level (7089.01) without reaching the order (7196.21) we recommend cancelling the order: the market sustains internal changes which were not taken into account.

Fundamental Analysis Indeks - Indeks Bursa Efek Australia

Australia’s consumer confidence and PMI improved more than forecast. Will the AU200 increase continue?

Australia’s economic data in the last couple of weeks were positive on balance: consumer confidence improved in February and private sector contraction halted in January. The Westpac Bank Consumer Sentiment Index for Australia rose 2.3% over month to 95.5 in January 2020 from 93.4 in the previous month. And the Commonwealth Bank Composite PMI for Australia was revised upward to 50.2 in January of 2020 from a preliminary estimate of 48.6. Readings below 50 indicate contraction while higher readings point to expansion. December's reading was 49.6. And while the latest labor market report showed unemployment rate up-ticked to 5.3% from 5.1% in December, it was partly due to increased rate of labor force participation. Improving data are bullish for AU200. However, the Commonwealth Bank Composite PMI for Australia came in today at 48.3 for February, down from a final reading of 50.2 in January, indicating contraction in the private sector. Further deterioration in Australia’s economic performance is a downside risk.

Perhatian:

Tinjauan ini memiliki karakter informatif dan tutorial dan dipublikasikan secara gratis. Semua data, termasuk dalam Tinjauan, diterima dari sumber publik, diakui kurang lebih dapat diandalkan. Apalagi, tidak ada jaminan bahwa informasi yang ditunjukkan penuh dan tepat. tinjauan tidak diperbarui. Keseluruhan informasi dalam setiap tinjauan, termasuk pendapat, indikator, grafik dan hal lainnya, disediakan hanya untuk tujuan pengenalan dan bukan saran keuangan atau rekomendasi. Seluruh teks dan bagiannya, serta grafik tidak dapat dianggap sebagai tawaran untuk membuat kesepakatan dengan aset apa pun. Pasar IFC dan karyawannya dalam kondisi apapun tidak bertanggung jawab atas tindakan yang dilakukan oleh orang lain selama atau setelah membaca tinjauan.