- Analisis

- Analisis teknis

EUR/USD Analisis teknis - EUR/USD Jual beli: 2015-07-20

EUR/USD currency pair sustains the trend

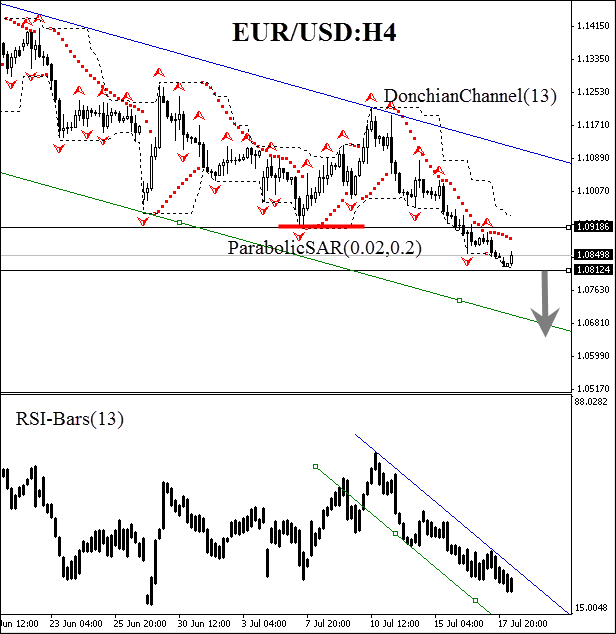

Let us consider the EUR/USD currency pair on the H4 chart. At the moment we observe a continuing bearish trend, determined by the eurozone crisis and the technical default in Greece. The price has breached the important support line at 1.09186 and successfully consolidated below this level. The mark now acts as a resistance line. Donchian Channel confirms the major trend. RSI-Bars assures our assumptions as well. However, we see a slight rebound.

We believe that all the represented analysis tools have been giving bearish signals. Conservative traders are recommended to wait until the next support line is crossed at 1.08124. This mark is supported by the Donchian Channel lower boundary. We can place a sell pending order there. A stop loss may be placed at the Donchian opposite boundary at 1.09186. This level is confirmed by Parabolic historical values and Bill Williams fractal. The stop loss is supposed to be moved every four hours to the next fractal high, following Parabolic signals. Thus, we change the probable profit/loss ratio to the breakeven point.

| Position | Sell |

| Sell stop | below 1.08124 |

| Stop loss | above 1.09186 |

Perhatian:

Tinjauan ini memiliki karakter informatif dan tutorial dan dipublikasikan secara gratis. Semua data, termasuk dalam Tinjauan, diterima dari sumber publik, diakui kurang lebih dapat diandalkan. Apalagi, tidak ada jaminan bahwa informasi yang ditunjukkan penuh dan tepat. tinjauan tidak diperbarui. Keseluruhan informasi dalam setiap tinjauan, termasuk pendapat, indikator, grafik dan hal lainnya, disediakan hanya untuk tujuan pengenalan dan bukan saran keuangan atau rekomendasi. Seluruh teks dan bagiannya, serta grafik tidak dapat dianggap sebagai tawaran untuk membuat kesepakatan dengan aset apa pun. Pasar IFC dan karyawannya dalam kondisi apapun tidak bertanggung jawab atas tindakan yang dilakukan oleh orang lain selama atau setelah membaca tinjauan.