- Analisis

- Analisis teknis

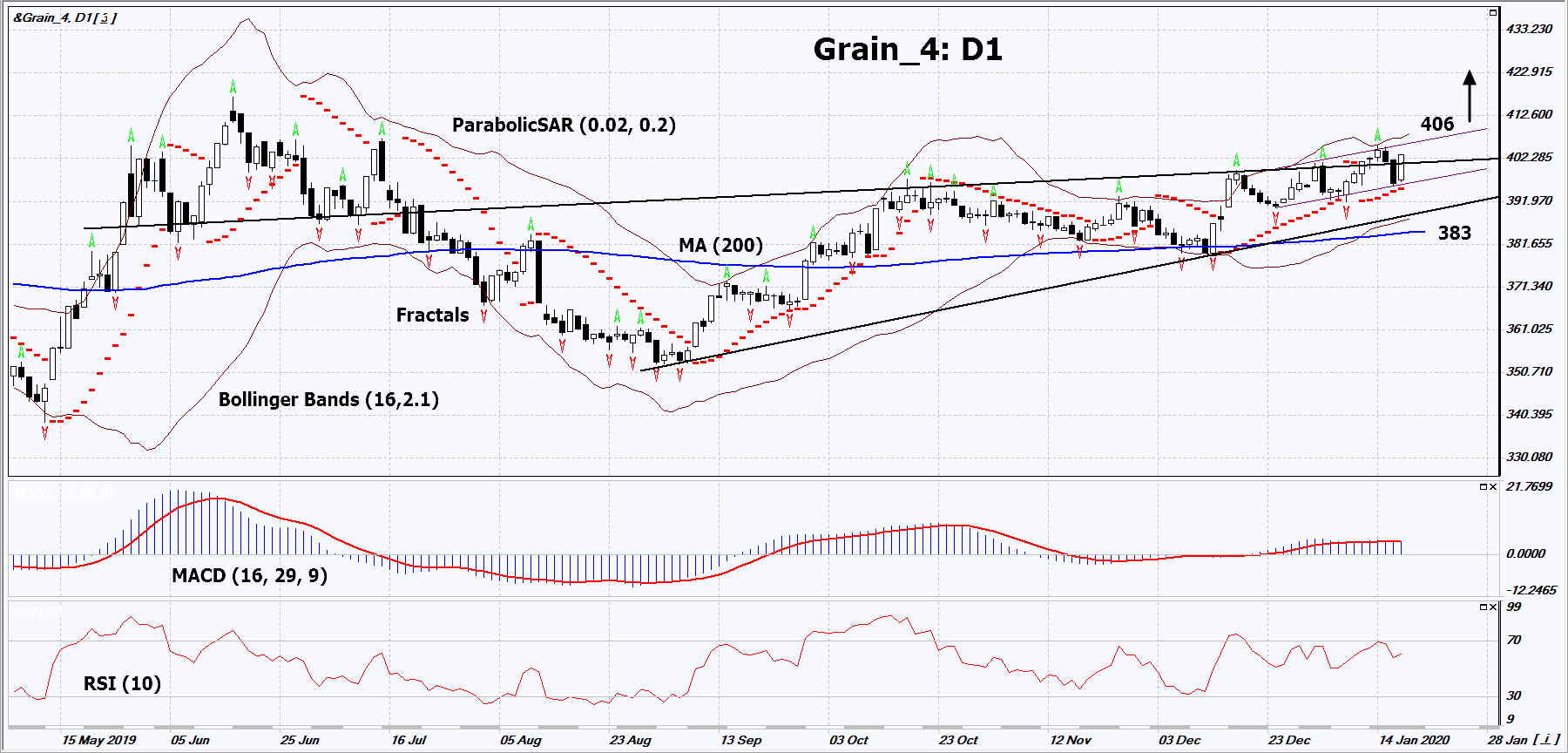

Grain Index Analisis teknis - Grain Index Jual beli: 2020-01-21

Indeks Grain Technical Analysis Summary

Atas 406

Buy Stop

Bawah 383

Stop Loss

| Indicator | Signal |

| RSI | Buy |

| MACD | Neutral |

| MA(200) | Buy |

| Parabolic SAR | Buy |

| Bollinger Bands | Buy |

Indeks Grain Chart Analysis

Indeks Grain Analisis Teknis

Grain_4 is in a rising channel and it is trying to move upward from the triangle . Part of the indicators formed a signal to increase.

The bullish momentum is not excluded if Grain_4 exceeds the last upper fractal and the upper line of the growing channel: 406. This level can be used as an entry point. the initial stop loss is possible below the 200-day moving midline, the last lower fractal, the lower Bollinger line and the Parabolic signal: 383. After the pending order is opened, the stop loss is moved after the Bollinger and Parabolic signals to the next fractal minimum. Thus, we are changing the potential profit / loss to the break-even point. the most risk-averse traders can switch to a four-hour chart and set a stop loss, moving it in the direction of trade. If the price meets the stop level (383) without activating the order (406), it is recommended to close the order: the market faces internal changes that haven’t been taken into account.

Fundamental Analysis - "}[/T]

In this review, we propose to consider the personal composite instrument (PCI) “& Grain_4”. It reflects the price dynamics of a portfolio of 4 popular grain commodities. Will quotes rise Grain_4?

Last week, the United States and China signed the first part of the foreign trade agreement. China agreed to increase purchases of US agricultural products, including grain, by $ 32 billion over the next 2 years to $ 80 billion (total in 2020 and 2021). Subsequently, China will increase imports of agricultural products from the United States to $ 50 billion a year. In addition, the US Senate approved the U.S.-Mexico-Canada Agreement (USMCA) trade agreement. The deficit of trade in goods between the United States and Mexico in 2018 amounted to $ 80.7 billion. The new agreement aim is to reduce it and for this Mexico (like China) will increase imports of American grain. All these may increase demand. In turn, world supply may be reduced due to fires in Australia and rains in France which interrupted sowing. Soft wheat sowing area in France decreased by 10% compared to 2019 to a 19-year low. In Australia, wheat crop may decline by 20%. This was reported by the Australian Bureau of Agricultural and Resource Economics and Sciences (ABARES).

Perhatian:

Tinjauan ini memiliki karakter informatif dan tutorial dan dipublikasikan secara gratis. Semua data, termasuk dalam Tinjauan, diterima dari sumber publik, diakui kurang lebih dapat diandalkan. Apalagi, tidak ada jaminan bahwa informasi yang ditunjukkan penuh dan tepat. tinjauan tidak diperbarui. Keseluruhan informasi dalam setiap tinjauan, termasuk pendapat, indikator, grafik dan hal lainnya, disediakan hanya untuk tujuan pengenalan dan bukan saran keuangan atau rekomendasi. Seluruh teks dan bagiannya, serta grafik tidak dapat dianggap sebagai tawaran untuk membuat kesepakatan dengan aset apa pun. Pasar IFC dan karyawannya dalam kondisi apapun tidak bertanggung jawab atas tindakan yang dilakukan oleh orang lain selama atau setelah membaca tinjauan.