- Perusahaan

- Widgets Situs web

Widget Finansial Online – Widget Forex

Apa Anda rasa situs web Anda kekurangan sesuatu dan Anda tidak tahu cara untuk menambahkan konten yang tepat? IFC Markets akan menyediakan segala yang Anda butuhkan secara gratis sepenuhnya: widget finansial untuk situs web, blog, atau forum. Buat situs web Anda lebih informatif dan pelanggan Anda lebih puas.

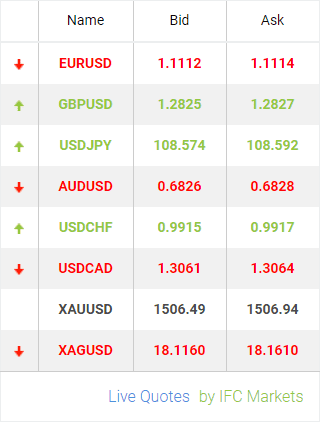

Tambahkan Kuotasi Saham Langsung gratis oleh IFC Markets dalam situs web Anda, blog atau Facebook page dan memberikan kesempatan untuk melacak pengunjung Anda kunci latest Exchange Rates yang diperbarui secara real time.

Anda dapat menghasilkan widget Grafik Live di situs web Anda, yang memungkinkan pengunjung untuk mengamati kuotasi live pasangan mata uang, saham, indeks, komoditas, dan logam mulia dalam berbagai kerangka waktu: mulai dari 5 menit hingga 1 minggu.

CiptakanDownload widget ini akan memberikan informasi terbaru mengenai pasar Forex dan CFD, yang akan membantu Anda untuk melakukan prediksi yang lebih akurat dan membuat keputusan trading yang lebih baik.

Unduh

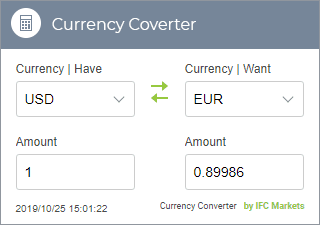

Currency Converter Widget adalah pelengkap mudah dan nyaman untuk website atau blog. kalkulator nilai tukar ini adalah widget kurs mata uang sederhana yang akan memungkinkan pengunjung Anda untuk menghitung tarif semua mata uang utama, serta menggunakan penukar mata uang secara langsung.

Konversi tersebut berlangsung secara real time.

Ciptakan

Dalam dunia yang terus berkembang ini, trading di pasar keuangan telah menjadi salah satu yang terbaik dan cara yang paling menarik untuk mencari keuntungan. Setiap hari jumlah orang yang memiliki pemikiran seperti mereka untuk memasuki dunia tanpa batas keuangan dan trading, meningkat dengan pesat. Namun, trading dalam pasar keuangan ini tidak mudah, karena mungkin tampak pertama kali terlihat hal itu membutuhkan banyak usaha dan tentu saja, pengetahuan. Untuk menjadi seorang trader yang sukses atau investor, ada beberapa faktor penting dalam mempertimbangkan ketika akan memasuki pasar keuangan. Salah satu faktor tersebut adalah untuk dapat mengikuti live market quotes pada saat itu juga.

Ciptakan

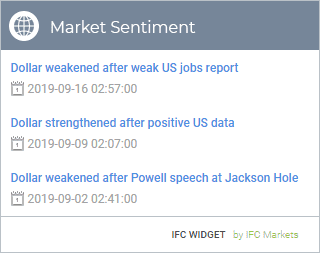

Widget sentimen pasar mencerminkan semua perubahan signifikan dalam keseimbangan secara terbuka posisi trader, serta mencakup semua grafik dan komentar yang diperlukan. Laporan Sentimen Pasar didasarkan pada data Commodity Futures Trading Commission (CFTC).

Ciptakan

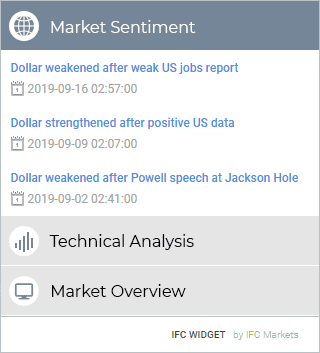

Gambaran Widget Pasar mencakup semua data terbaru tentang dunia keuangan. Widget akan memungkinkan Anda untuk mendapatkan ringkasan pasar harian, yang dibuat oleh analis profesional kami.

Ciptakan

Menempatkan Widget Analisis Teknis kami di website Anda, blog atau Facebook Page, sehingga memberikan kesempatan kepada trader untuk melihat secara real time ringkasan Analisis Teknis yang dibuat oleh analis profesional kami.

Ciptakan

Informasi yang rutin merupakan cara terbaik menjadikan pasar untuk lebih maju ke depan. Sekarang Anda tidak perlu menghabiskan sejumlah besar waktu untuk meninjau statistik, melakukan penelitian atau mencoba menerka pergerakan dari pasar Forex.

Ciptakan Explore our

Trading Conditions

- Spreads from 0.0 pip

- 30,000+ Trading Instruments

- Stop Out Level - Only 10%

Ready to Trade?

Open Account