- Analisis

- Analisis teknis

AUD/USD Analisis teknis - AUD/USD Jual beli: 2020-01-22

AUD/USD Technical Analysis Summary

Bawah 0,6835

Sell Stop

Atas 0,6942

Stop Loss

| Indicator | Signal |

| RSI | Neutral |

| MACD | Sell |

| MA(200) | Sell |

| Bollinger Bands | Sell |

| Parabolic SAR | Sell |

AUD/USD Chart Analysis

AUD/USD Analisis Teknis

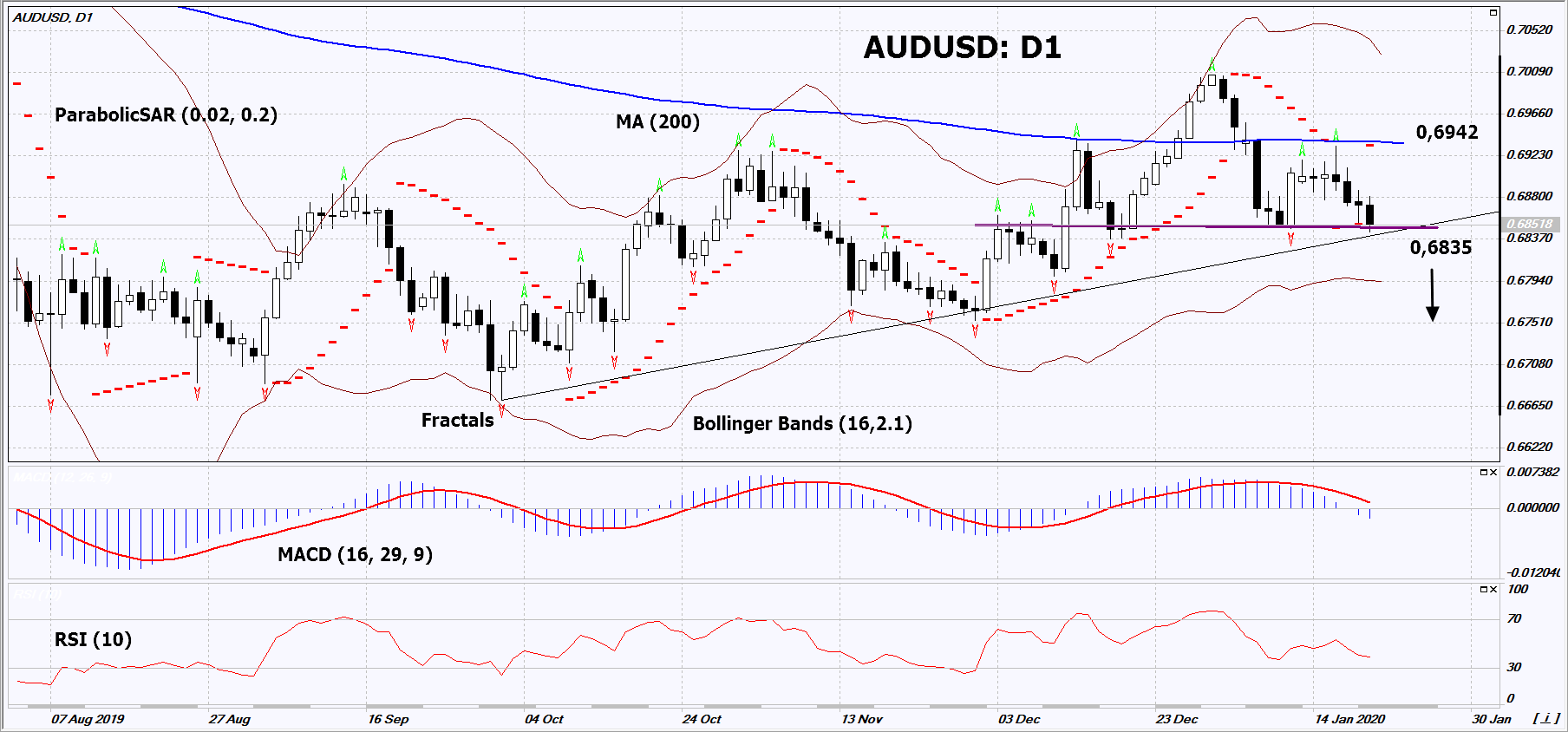

On the daily timeframe, the AUDUSD: D1 approached the neck line of the "head-shoulders" chart pattern of technical analysis.. It should be breached down before opening a position.

The bearish momentum may develop in case AUDUSD falls below the two last fractal lows at 0.6835. This level may serve as an entry point. The initial stop loss may be placed above the last fractal high, the 200-day moving average line and the Parabolic signal at 0.6942. After opening the pending order, we shall move the stop to the next fractal low following the Bollinger and Parabolic signals. Thus, we are changing the potential profit/loss to the breakeven point. More risk-averse traders may switch to the 4-hour chart after the trade and place there a stop loss moving it in the direction of the trade. If the price meets the stop level(0.6942) without reaching the order (0.6835), we recommend closing the position: the market sustains internal changes that were not taken into account.

Fundamental Analysis - "}[/T]

China is the main trading partner of Australia. Chinese stock indices have decreased significantly, as investors fear that the viral infection will hurt the economy. Will the AUDUSD? fall

The Severe Acute Respiratory Syndrome (SARS) virus has spread in China and it can damage the economy and reduce demand for raw materials, including Australian ones. Another negative factor for the Australian dollar is the plan of the Reserve Bank of Australia (RBA) to cut the rate, which is now 0.75%. According to Fed Funds futures, the probability of this is 42% at the next meeting on February 4, 2020, and 62% at the meeting in March. While making a decision on a rate, the RBA will take into account the Consumer Sentiment Index for January, which will be released on January 22. This week, on Thursday and Friday, other significant macroeconomic data will published in Australia: unemployment and labor market indicators for December, as well as 3 PMI indices (industrial, service industries and composite) for January.

Explore our

Trading Conditions

- Spreads from 0.0 pip

- 30,000+ Trading Instruments

- Stop Out Level - Only 10%

Ready to Trade?

Open Account Perhatian:

Tinjauan ini memiliki karakter informatif dan tutorial dan dipublikasikan secara gratis. Semua data, termasuk dalam Tinjauan, diterima dari sumber publik, diakui kurang lebih dapat diandalkan. Apalagi, tidak ada jaminan bahwa informasi yang ditunjukkan penuh dan tepat. tinjauan tidak diperbarui. Keseluruhan informasi dalam setiap tinjauan, termasuk pendapat, indikator, grafik dan hal lainnya, disediakan hanya untuk tujuan pengenalan dan bukan saran keuangan atau rekomendasi. Seluruh teks dan bagiannya, serta grafik tidak dapat dianggap sebagai tawaran untuk membuat kesepakatan dengan aset apa pun. Pasar IFC dan karyawannya dalam kondisi apapun tidak bertanggung jawab atas tindakan yang dilakukan oleh orang lain selama atau setelah membaca tinjauan.