- Analisis

- Analisis teknis

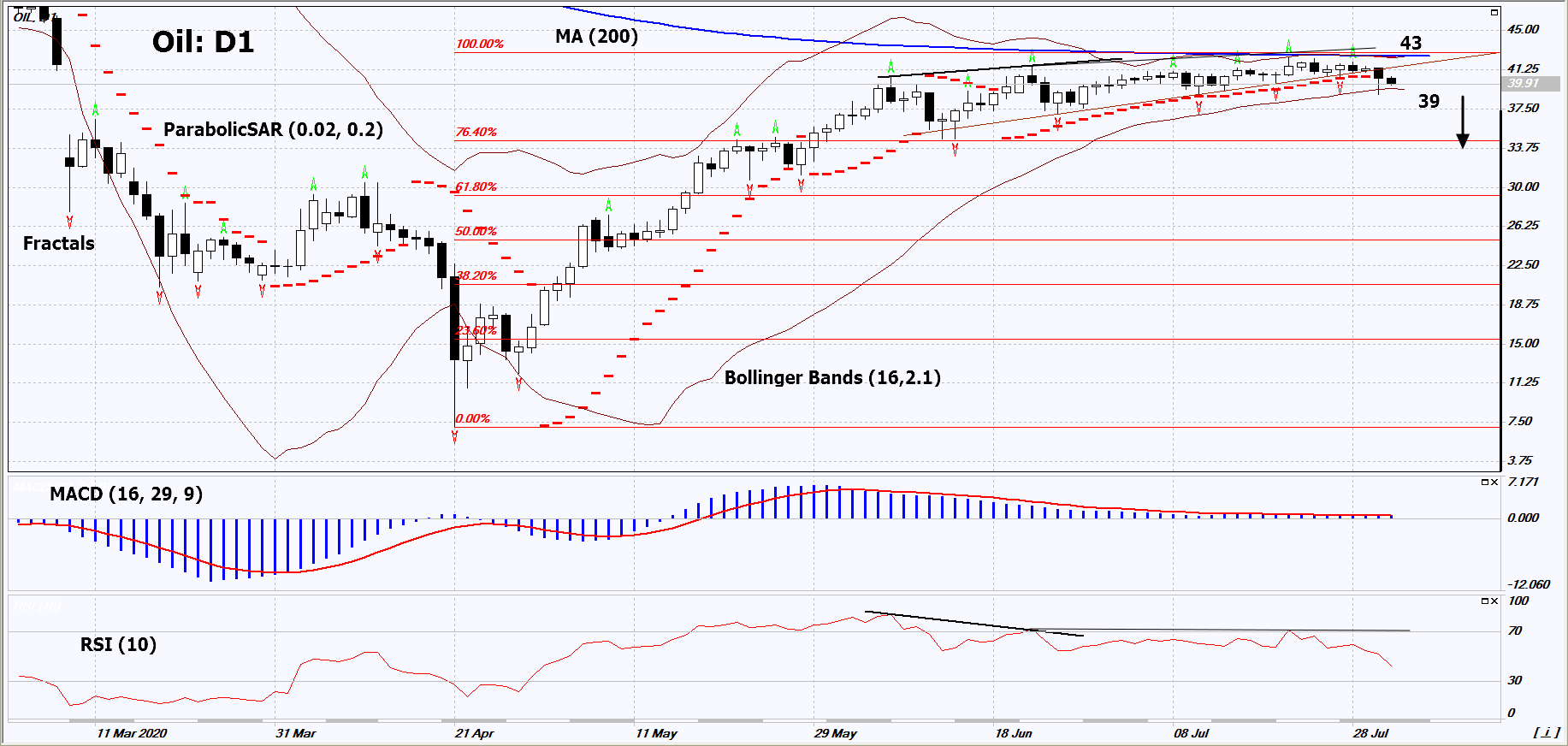

Minyak Mentah Analisis teknis - Minyak Mentah Jual beli: 2020-08-03

Oil Technical Analysis Summary

Bawah 39

Sell Stop

Atas 43

Stop Loss

| Indicator | Signal |

| RSI | Sell |

| MACD | Neutral |

| MA(200) | Neutral |

| Fractals | Neutral |

| Parabolic SAR | Sell |

| Bollinger Bands | Neutral |

Oil Chart Analysis

Oil Analisis Teknis

On the daily timeframe, Oil: D1 is being traded in a narrow neutral range for almost 2 months. A number of technical analysis indicators formed signals for a decline. We do not rule out a bearish movement if Oil falls below the lower Bollinger band: 39. This level can be used as an entry point. We can set a stop loss above the last two upper fractals, the upper Bollinger line, the 200-day moving average line and the Parabolic signal: 43. After opening a pending order, we should move the stop loss following the Bollinger and Parabolic signals to the next fractal low. Thus, we change the potential profit/loss ratio in our favor. The most risk-averse traders, after the transaction, can switch to a four-hour chart and set a stop loss, moving it in the direction of the bias. If the price meets the stop loss (43) without activating the order (39), it is recommended to delete the order: some internal changes in the market have not been taken into account.

Fundamental Analysis Komoditas - Oil

Since August 1, 2020, OPEC + countries will increase oil production by 1.5 million barrels per day (bpd). Will oil quotes go down ?

On July 15, 2020, the OPEC + countries agreed to reduce the oil production limit from 9.7 million bpd to 7.7 million bpd from August 1. This means that the difference (or 2 million bpd) will additionally enter the world market. The real increase will be less, and will amount to 1.5 million bpd, as a number of countries such as Iraq and Nigeria have exceeded their oil production quotas in the past. In May, the overall OPEC + reduction quota was met by only 87%, bringing additional 1.26 million barrels per day to the world market. This did not prevent the growth in oil quotes. In June, the quota was met by 107%. The next increase in production, by another 2 million bpd, is expected only in early 2021, when the OPEC + production limit will be reduced to 5.7 million bpd. The continuation of the coronavirus pandemic may be another negative factor for oil prices. A number of countries are inclined to reintroduce quarantine, which will lead to lower demand.

Explore our

Trading Conditions

- Spreads from 0.0 pip

- 30,000+ Trading Instruments

- Stop Out Level - Only 10%

Ready to Trade?

Open Account Perhatian:

Tinjauan ini memiliki karakter informatif dan tutorial dan dipublikasikan secara gratis. Semua data, termasuk dalam Tinjauan, diterima dari sumber publik, diakui kurang lebih dapat diandalkan. Apalagi, tidak ada jaminan bahwa informasi yang ditunjukkan penuh dan tepat. tinjauan tidak diperbarui. Keseluruhan informasi dalam setiap tinjauan, termasuk pendapat, indikator, grafik dan hal lainnya, disediakan hanya untuk tujuan pengenalan dan bukan saran keuangan atau rekomendasi. Seluruh teks dan bagiannya, serta grafik tidak dapat dianggap sebagai tawaran untuk membuat kesepakatan dengan aset apa pun. Pasar IFC dan karyawannya dalam kondisi apapun tidak bertanggung jawab atas tindakan yang dilakukan oleh orang lain selama atau setelah membaca tinjauan.