- Analisis

- Analisis teknis

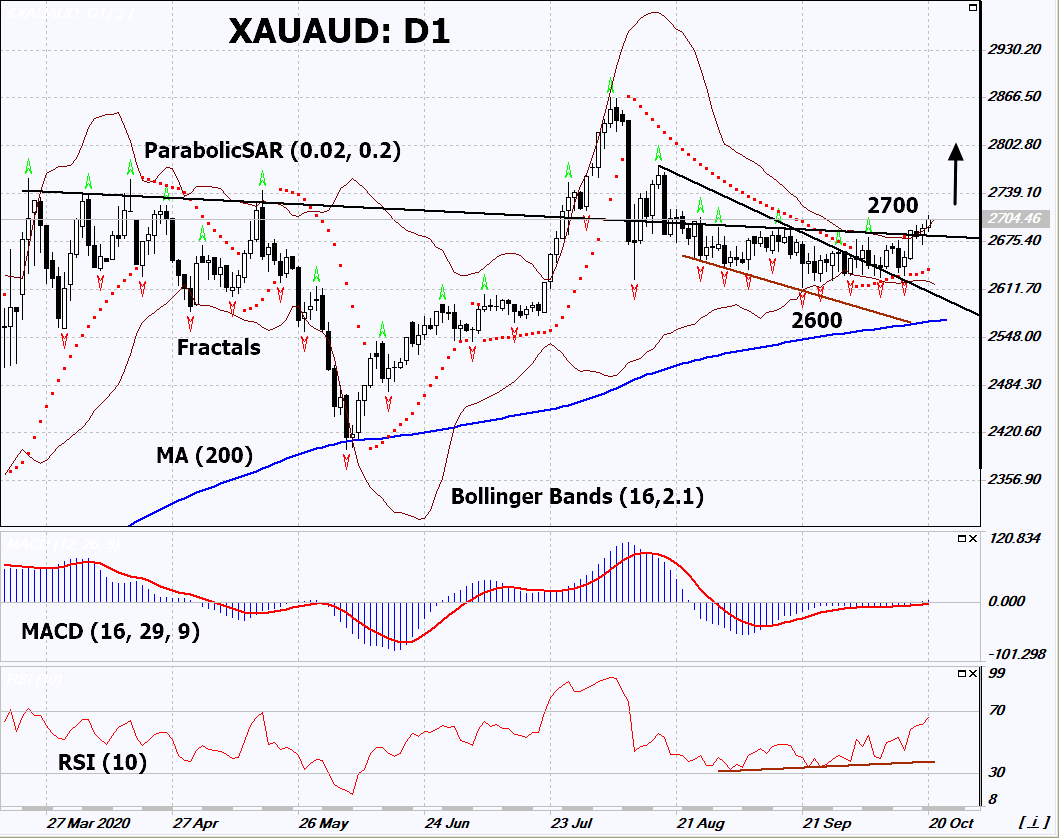

Gold vs AUD Analisis teknis - Gold vs AUD Jual beli: 2020-10-21

Emas vs AUD Technical Analysis Summary

Atas 2700

Buy Stop

Bawah 2600

Stop Loss

| Indicator | Signal |

| RSI | Buy |

| MACD | Neutral |

| MA(200) | Neutral |

| Fractals | Buy |

| Parabolic SAR | Buy |

| Bollinger Bands | Buy |

Emas vs AUD Chart Analysis

Emas vs AUD Analisis Teknis

On the daily timeframe, XAUAUD: D1 exceeded the downtrend resistance line. A number of technical analysis indicators formed signals for further growth. We do not rule out a bullish move if XAUAUD rises above its last maximum: 2700-2710. This level can be used as an entry point. We can place a stop loss below the Parabolic signal and the lower Bollinger line: 2600. After opening a pending order, we can move the stop loss following the Bollinger and Parabolic signals to the next fractal low. Thus, we change the potential profit/loss ratio in our favor. After the transaction, the most risk-averse traders can switch the 4-hour chart and place a stop loss, moving it in the direction of the bias. If the price meets the stop loss (2600) without activating the order (2700), it is recommended to delete the order: some internal changes in the market have were not been taken into account.

Fundamental Analysis PCI - Emas vs AUD

In this review, we propose to consider the XAUAUD Personal Composite Instrument (PCI). It reflects the price action of Gold vs the Australian dollar. Is the growth of XAUAUD quotes possible?

XAUAUD moves up with the weakening of the Australian dollar and the rise in gold prices. The main negative factor for the Australian currency is the plans of the RBA to ease its monetary policy and, in particular, to cut the rate to 0.1% from the current 0.25%. This was noted in the RBA Meeting minutes. In theory, the rate could be lowered at the next meeting on November 3. On Tuesday, Assistant Governor RBA Chris Kent said that his department didn't not rule out negative rates, as well as a significant currency issue aimed at bonds buybacks (following the example of the US Federal Reserve's QE program). In turn, gold may rise in price amid growing global risks due to the 2nd wave of coronavirus, uncertainty around the US presidential election, as well as US-China foreign trade disputes. In addition, demand for precious metals may increase if inflation rises and rates remain low in the most developed countries.

Explore our

Trading Conditions

- Spreads from 0.0 pip

- 30,000+ Trading Instruments

- Stop Out Level - Only 10%

Ready to Trade?

Open Account Perhatian:

Tinjauan ini memiliki karakter informatif dan tutorial dan dipublikasikan secara gratis. Semua data, termasuk dalam Tinjauan, diterima dari sumber publik, diakui kurang lebih dapat diandalkan. Apalagi, tidak ada jaminan bahwa informasi yang ditunjukkan penuh dan tepat. tinjauan tidak diperbarui. Keseluruhan informasi dalam setiap tinjauan, termasuk pendapat, indikator, grafik dan hal lainnya, disediakan hanya untuk tujuan pengenalan dan bukan saran keuangan atau rekomendasi. Seluruh teks dan bagiannya, serta grafik tidak dapat dianggap sebagai tawaran untuk membuat kesepakatan dengan aset apa pun. Pasar IFC dan karyawannya dalam kondisi apapun tidak bertanggung jawab atas tindakan yang dilakukan oleh orang lain selama atau setelah membaca tinjauan.