- Analisis

- Analisis teknis

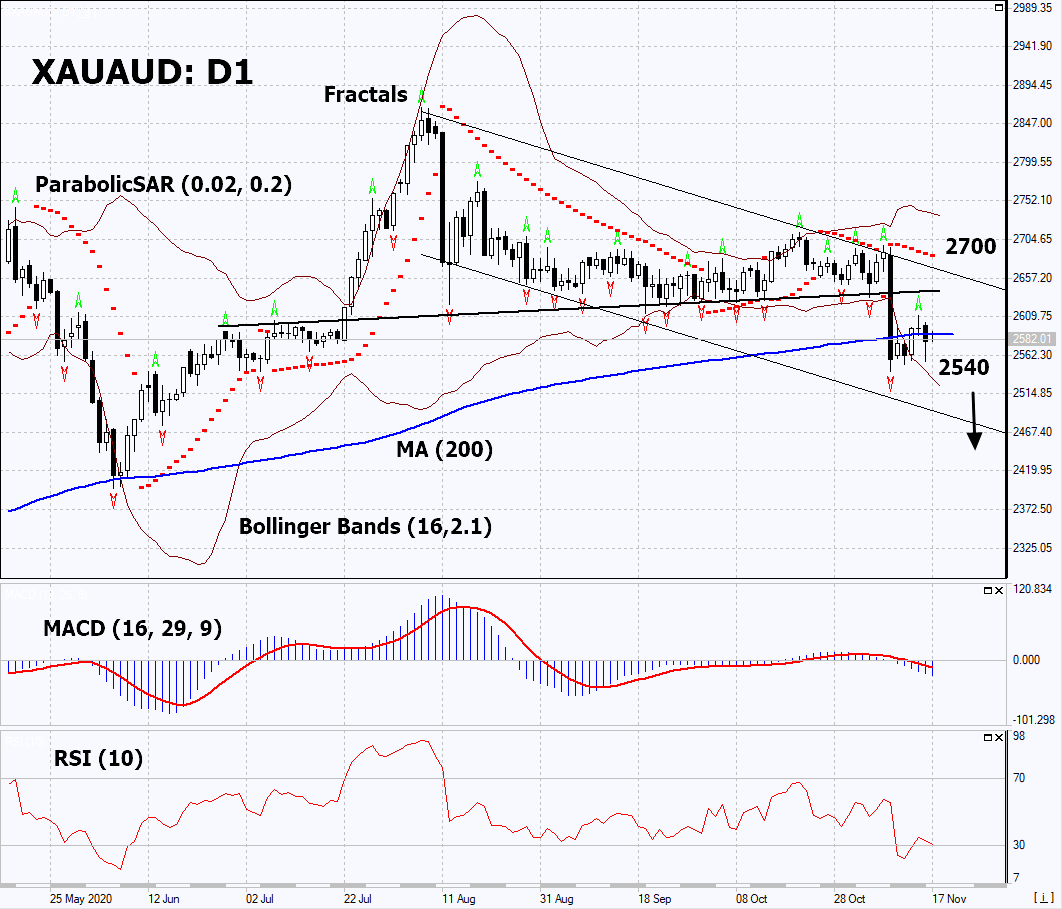

Gold vs AUD Analisis teknis - Gold vs AUD Jual beli: 2020-11-18

Emas vs AUD Technical Analysis Summary

Bawah 2540

Sell Stop

Atas 2700

Stop Loss

| Indicator | Signal |

| RSI | Neutral |

| MACD | Sell |

| MA(200) | Neutral |

| Fractals | Neutral |

| Parabolic SAR | Sell |

| Bollinger Bands | Sell |

Emas vs AUD Chart Analysis

Emas vs AUD Analisis Teknis

On the daily timeframe, XAUAUD: D1 is correcting down from the historical high. It broke down the downtrend support line and is below the 200-day moving average at the moment. A number of technical analysis indicators formed signals for further decline. We do not rule out a bearish movement if XAUAUD falls below the last lower fractal: 2540. This level can be used as an entry point. We can place a stop loss above the last upper fractal and Parabolic signal: 2700. After opening a pending order, we can move the stop loss following the Bollinger and Parabolic signals to the next fractal maximum. Thus, we change the potential profit/loss ratio in our favor. After the transaction, the most risk-averse traders can switch to the 4-hour chart and set a stop loss, moving it in the direction of the bias. If the price meets the stop loss (2700) without activating the order (2540), it is recommended to delete the order: the market is undergoing internal changes not taken into account.

Fundamental Analysis PCI - Emas vs AUD

In this review, we propose to consider the XAUAUD Personal Composite Instrument (PCI). It reflects the price action of gold against the Australian dollar. Will the XAUAUD continue to decline?

The downward movement shows the decline in gold prices and the strengthening of the Australian dollar. As we mentioned in the previous review, the development of vaccines against Covid-19 may reduce global risks and the gold demand. Over the past 2 years, gold has almost doubled in price. This led to the reduction of its demand in the jewelry industry, as jewelry buyers from developing countries have not yet adapted to such high prices. Some investors even believe that if the coronavirus vaccination is successful, the American economy may not need additional funds to recover from the pandemic, or their volume may be cut. Unlike gold, the Australian dollar has the potential to benefit significantly from the rapid end of the Covid-19 pandemic. Like the Australian economy, the Australian dollar is also supported by increased global trade activity and strong Chinese statistics, as China is the main buyer of Australian commodities. In October, the Chinese macroeconomic data was positive. Industrial production and retail sales increased, while unemployment fell.

Explore our

Trading Conditions

- Spreads from 0.0 pip

- 30,000+ Trading Instruments

- Stop Out Level - Only 10%

Ready to Trade?

Open Account Perhatian:

Tinjauan ini memiliki karakter informatif dan tutorial dan dipublikasikan secara gratis. Semua data, termasuk dalam Tinjauan, diterima dari sumber publik, diakui kurang lebih dapat diandalkan. Apalagi, tidak ada jaminan bahwa informasi yang ditunjukkan penuh dan tepat. tinjauan tidak diperbarui. Keseluruhan informasi dalam setiap tinjauan, termasuk pendapat, indikator, grafik dan hal lainnya, disediakan hanya untuk tujuan pengenalan dan bukan saran keuangan atau rekomendasi. Seluruh teks dan bagiannya, serta grafik tidak dapat dianggap sebagai tawaran untuk membuat kesepakatan dengan aset apa pun. Pasar IFC dan karyawannya dalam kondisi apapun tidak bertanggung jawab atas tindakan yang dilakukan oleh orang lain selama atau setelah membaca tinjauan.