- Analisis

- Analisis teknis

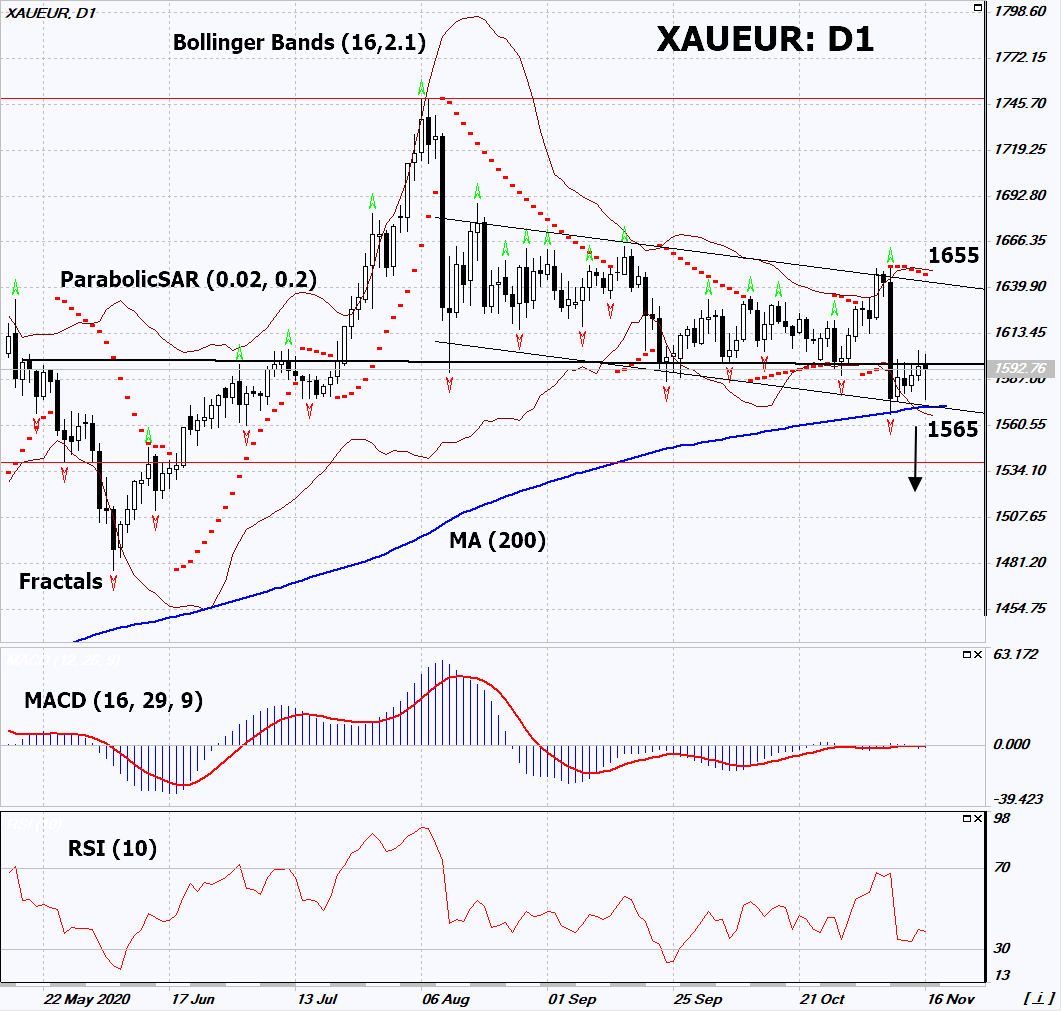

Gold Analisis teknis - Gold Jual beli: 2020-11-17

Gold Euro Technical Analysis Summary

Bawah 1565

Sell Stop

Atas 1655

Stop Loss

| Indicator | Signal |

| RSI | Neutral |

| MACD | Neutral |

| MA(200) | Neutral |

| Fractals | Neutral |

| Parabolic SAR | Sell |

| Bollinger Bands | Neutral |

Gold Euro Chart Analysis

Gold Euro Analisis Teknis

On the daily timeframe, XAUEUR: D1 is correcting downward from the historical high. It approached the downtrend support line. It must be broken down before opening a position. A number of technical analysis indicators formed signals for further decline. We do not rule out a bearish movement if XAUEUR falls below the 200-day moving average, the last lower fractal and the lower Bollinger line: 1565. This level can be used as an entry point. We can place a stop loss above the last upper fractal, upper Bollinger line and Parabolic signal: 1655. After opening a pending order, we move the stop loss following the Bollinger and Parabolic signals to the next fractal maximum. Thus, we change the potential profit/loss ratio in our favor. After the transaction, the most risk-averse traders can switch to the 4-hour chart and set a stop loss, moving it in the direction of the bias. If the price meets the stop loss (1565) without activating the order (1655), it is recommended to delete the order: the market sustains internal changes that have not been taken into account.

Fundamental Analysis Logam Mulia - Gold Euro

The development of Covid-19 vaccines may reduce global risks and the demand for gold. Will the XAUEUR quotations continue to decrease?

The downward movement means that gold is depreciating as the euro strengthens. Last week, American companies Moderna and Pfizer announced the creation of vaccines. A little earlier, Russia announced the creation of its own vaccine. Mass vaccination can end the coronavirus pandemic. Over the past 2 years, gold almost doubled in price, which significantly lessened the demand for the jewelry of the main buyers - Asian countries. At the same time, the share of investment demand for precious metals rose. Let's note that investment demand for gold is volatile and depends on global risks. Regarding the euro, it is worth mentioning the EU leaders' summit on Thursday and Friday. It is expected that the ECB head Christine Lagarde will speak. Most likely, this may turn out to be positive for the single European currency.

Explore our

Trading Conditions

- Spreads from 0.0 pip

- 30,000+ Trading Instruments

- Stop Out Level - Only 10%

Ready to Trade?

Open Account Perhatian:

Tinjauan ini memiliki karakter informatif dan tutorial dan dipublikasikan secara gratis. Semua data, termasuk dalam Tinjauan, diterima dari sumber publik, diakui kurang lebih dapat diandalkan. Apalagi, tidak ada jaminan bahwa informasi yang ditunjukkan penuh dan tepat. tinjauan tidak diperbarui. Keseluruhan informasi dalam setiap tinjauan, termasuk pendapat, indikator, grafik dan hal lainnya, disediakan hanya untuk tujuan pengenalan dan bukan saran keuangan atau rekomendasi. Seluruh teks dan bagiannya, serta grafik tidak dapat dianggap sebagai tawaran untuk membuat kesepakatan dengan aset apa pun. Pasar IFC dan karyawannya dalam kondisi apapun tidak bertanggung jawab atas tindakan yang dilakukan oleh orang lain selama atau setelah membaca tinjauan.