- Inovasi

- Instrumen Sintetis

- An Example of Creating, Analyzing and Trading PCI

An Example of Creating, Analyzing and Trading PCI

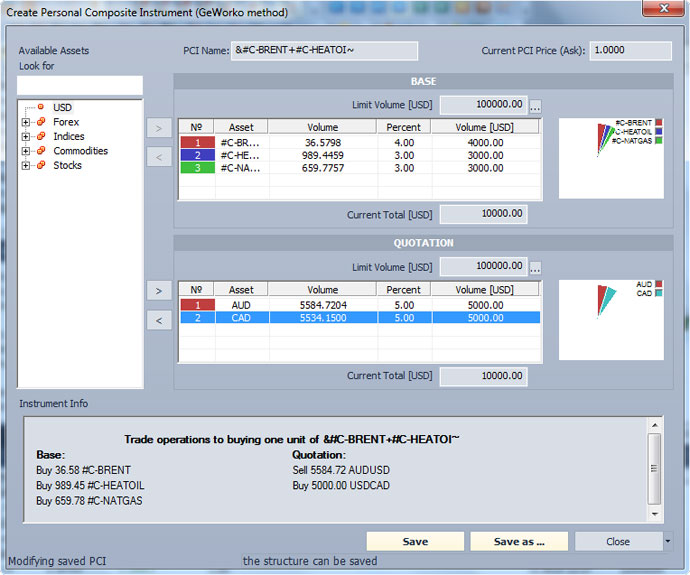

Let us consider an example of trading a quite complex personal instrument, consisting of two portfolios. The base portfolio consists of three energy assets (from Commodity CFDs category, available on the terminal) - #C-BRENT, #C-NATGAS, #C-HEATOIL, the quoted portfolio consists of two commodity currencies – AUD and CAD. In our example we will set assets of the base part in the following portions of the current value of the asset: #C-BRENT - 4000 USD, #C-NATGAS - 3000 USD, #C-HEATOIL – 3000 USD (the weight of Oil is more); and assets in the quoted part – in portions, equal to 5000USD for an asset (note that in general, the values of the base and quoted portfolios can be set not equally).

A personal instrument is created (with the name “&Energy/Currency_cmd”, given by the user

We will add this instrument to the list of ''Instruments in Use'' (in ''Market Watch'' window) and will reflect on the chart with an example of simple technical analysis.

Buying 1 unit of “&Energy/Currency_com” instrument means buying corresponding commodities in volumes, set in the new instrument, and selling corresponding currencies from the quoted portfolio. Moreover, selling the AUD means selling the AUDUSD and selling the CAD means buying the USDCAD. Accordingly, selling this PCI means selling assets of the base portfolio and buying assets of the quoted one.

The user can view properties of open positions on the new instrument and on its components in the table of ''Open positions''.