- Analisis

- Analisis teknis

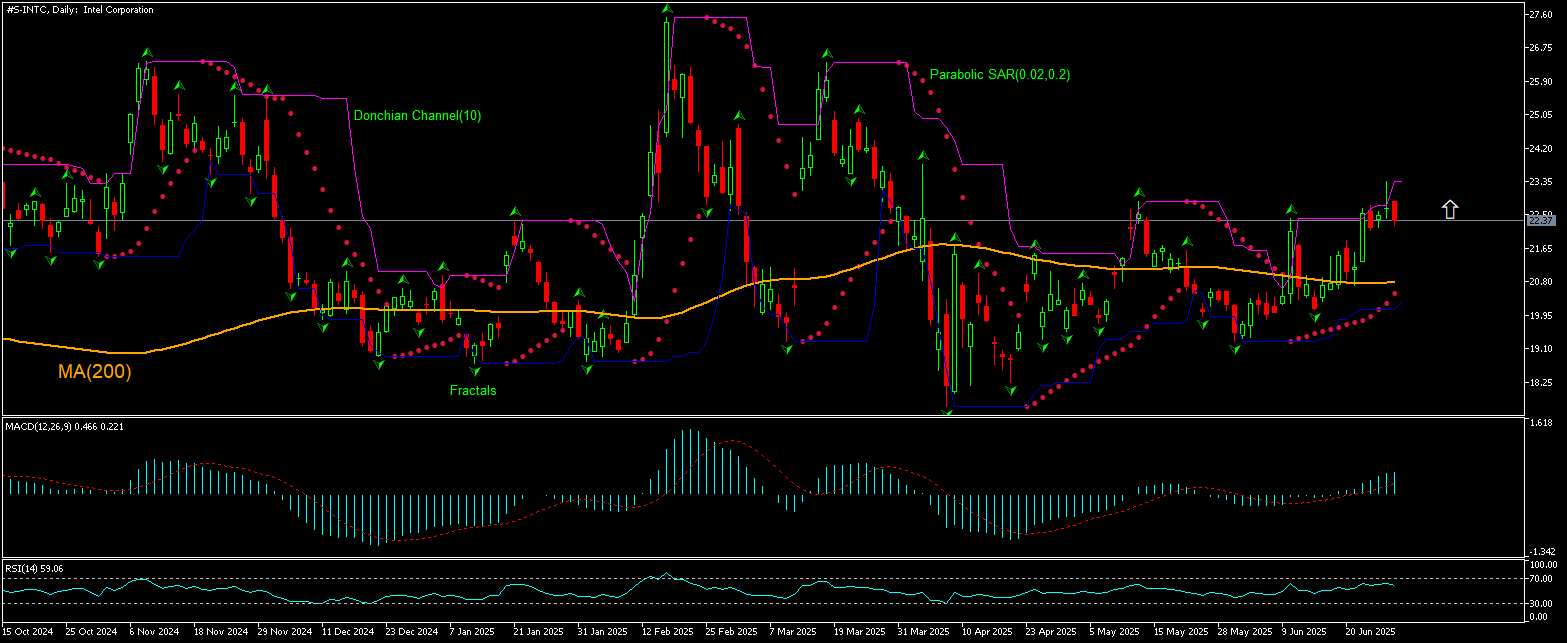

Intel Analisis teknis - Intel Jual beli: 2025-07-02

Intel Technical Analysis Summary

Atas 23.35

Buy Stop

Bawah 20.79

Stop Loss

| Indicator | Signal |

| RSI | Neutral |

| MACD | Buy |

| Donchian Channel | Buy |

| MA(200) | Buy |

| Fractals | Buy |

| Parabolic SAR | Buy |

Intel Chart Analysis

Intel Analisis Teknis

The technical analysis of the Intel stock price chart on daily timeframe shows #S-INTC,Daily is rising above the 200-day moving average MA(200) after returning above MA(200) two weeks ago. We believe the bullish momentum will continue after the price breaches above the upper boundary of Donchian channel at 23.35. This level can be used as an entry point for placing a pending order to buy. The stop loss can be placed below 20.79. After placing the order, the stop loss is to be moved every day to the next fractal low, following Parabolic indicator signals. Thus, we are changing the expected profit/loss ratio to the breakeven point. If the price meets the stop loss level (20.79) without reaching the order (23.35), we recommend cancelling the order: the market has undergone internal changes which were not taken into account.

Fundamental Analysis Saham - Intel

Intel announced a partnership with Exostellar to scale AI initiatives faster. Will the Intel stock price continue rebounding?

Intel Corporation announced it has partnered with Exostellar to make enterprise-grade AI infrastructure accessible in a cost-effective manner. The chip maker expects the partnership will enable it achieve deployment of cost-effective AI infrastructure by building end-to-end solutions with support for quota enforcement, dynamic borrowing, fair queuing and priority-based scheduling. This is expected in turn to bring cloud-like agility and efficiency to on-premises or hybrid infrastructure for a more competitive AI hardware ecosystem. Intel is on track with its 5N4Y - five nodes in four years - program to regain transistor performance and power performance leadership by 2025 as Intel Xeon platforms have set the benchmark in 5G cloud-native core with substantial performance and power-efficiency improvements, additional power-saving capabilities and easy-to-deploy software. Expectations of improved competitiveness of Intel AI hardware is bullish for Intel stock price.

Explore our

Trading Conditions

- Spreads from 0.0 pip

- 30,000+ Trading Instruments

- Instant Execution

Ready to Trade?

Open Account Perhatian:

Tinjauan ini memiliki karakter informatif dan tutorial dan dipublikasikan secara gratis. Semua data, termasuk dalam Tinjauan, diterima dari sumber publik, diakui kurang lebih dapat diandalkan. Apalagi, tidak ada jaminan bahwa informasi yang ditunjukkan penuh dan tepat. tinjauan tidak diperbarui. Keseluruhan informasi dalam setiap tinjauan, termasuk pendapat, indikator, grafik dan hal lainnya, disediakan hanya untuk tujuan pengenalan dan bukan saran keuangan atau rekomendasi. Seluruh teks dan bagiannya, serta grafik tidak dapat dianggap sebagai tawaran untuk membuat kesepakatan dengan aset apa pun. Pasar IFC dan karyawannya dalam kondisi apapun tidak bertanggung jawab atas tindakan yang dilakukan oleh orang lain selama atau setelah membaca tinjauan.