- Analisis

- Analisis teknis

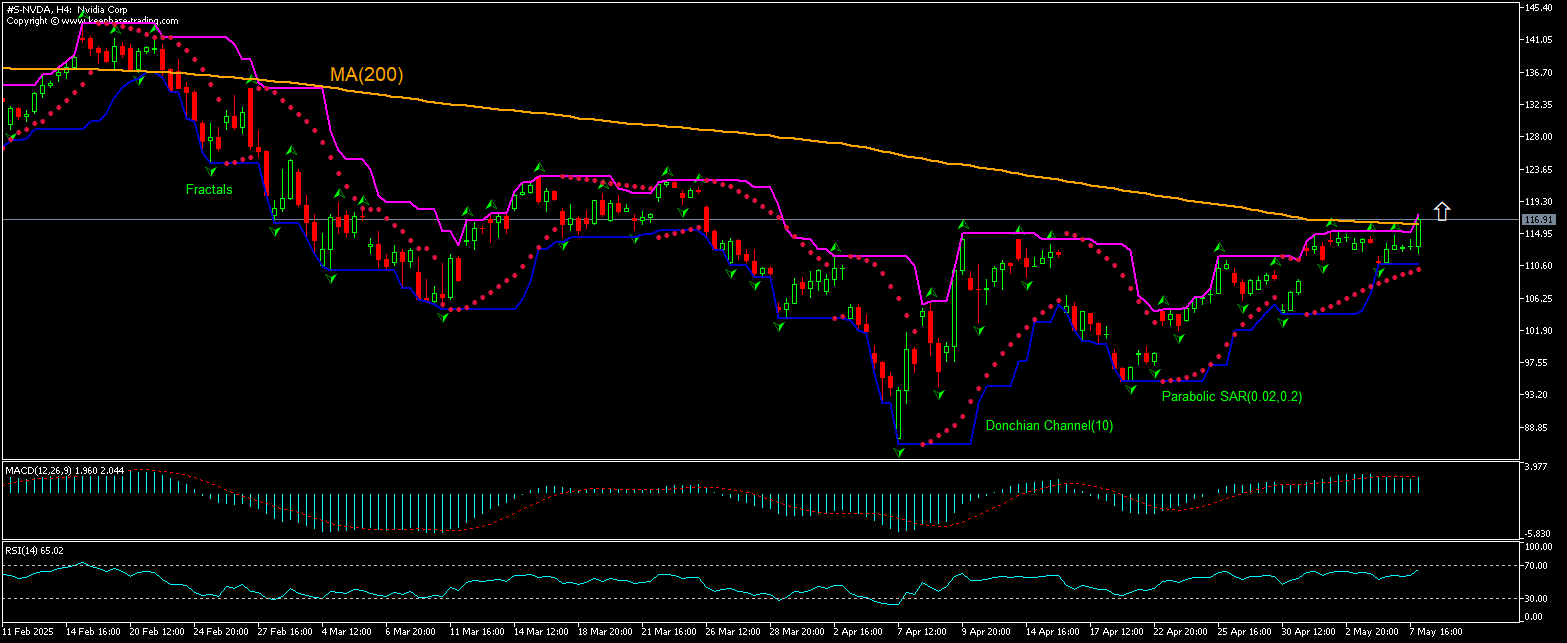

Nvidia Corp. Analisis teknis - Nvidia Corp. Jual beli: 2025-05-08

Nvidia Corp. Technical Analysis Summary

Atas 117.54

Buy Stop

Bawah 110.74

Stop Loss

| Indicator | Signal |

| RSI | Neutral |

| MACD | Buy |

| Donchian Channel | Buy |

| MA(200) | Sell |

| Fractals | Buy |

| Parabolic SAR | Buy |

Nvidia Corp. Chart Analysis

Nvidia Corp. Analisis Teknis

The technical analysis of the Nvidia stock price chart on 4-hour timeframe shows #S-NVDA,H4 is testing the 200-period moving average MA(200) which is declining still. We believe the bullish momentum will persist after the price breaches above the upper boundary of Donchian channel at 117.54. This level can be used as an entry point for placing a pending order to buy. The stop loss can be placed below 110.74. After placing the order, the stop loss is to be moved every day to the next fractal low, following Parabolic indicator signals. Thus, we are changing the expected profit/loss ratio to the breakeven point. If the price meets the stop loss level (110.74) without reaching the order (117.54), we recommend cancelling the order: the market has undergone internal changes which were not taken into account.

Fundamental Analysis Saham - Nvidia Corp.

Nvidia stock price rose after news US plans to lift chip restrictions. Will the Nvidia stock price continue advancing?

Nvidia stock closed 3.1% higher on the day after news US plans to lift chip export restrictions known as AI diffusion rule. The rule, introduced in the final week of president Biden’s tenure, requires creation of US licenses for AI chip shipments by intermediaries to third parties globally. There were reports Trump administration intends to rescind the AI diffusion rule that is set to take effect on May 15. The Commerce Department revealed that the repeal strategy involves imposing chip controls on countries that have redirected chips to China, such as Malaysia and Thailand, while continuing strict enforcement of existing chip export curbs. Possible easing of regulation may result in increase in US semiconductor industry export revenues which is bullish for Nvidia stock price.

Perhatian:

Tinjauan ini memiliki karakter informatif dan tutorial dan dipublikasikan secara gratis. Semua data, termasuk dalam Tinjauan, diterima dari sumber publik, diakui kurang lebih dapat diandalkan. Apalagi, tidak ada jaminan bahwa informasi yang ditunjukkan penuh dan tepat. tinjauan tidak diperbarui. Keseluruhan informasi dalam setiap tinjauan, termasuk pendapat, indikator, grafik dan hal lainnya, disediakan hanya untuk tujuan pengenalan dan bukan saran keuangan atau rekomendasi. Seluruh teks dan bagiannya, serta grafik tidak dapat dianggap sebagai tawaran untuk membuat kesepakatan dengan aset apa pun. Pasar IFC dan karyawannya dalam kondisi apapun tidak bertanggung jawab atas tindakan yang dilakukan oleh orang lain selama atau setelah membaca tinjauan.