- Analisis

- Analisis teknis

USD/CNH Analisis teknis - USD/CNH Jual beli: 2019-02-14

The Chinese yuan can react to results of trade negotiations and statistics

The tough position of US President Donald Trump on reducing the trade deficit with China may have a negative impact on the yuan exchange rate. Will the USDCNH rise?

Such dynamics indicate the weakening of the Chinese currency. Representatives of the United States and China are discussing a new trade agreement between the two countries on February 13-14. It was initiated by the United States to reduce the trade deficit with China, reaching $500 billion a year. According to Donald Trump, in order to reduce the trade deficit, China should either cut its exports to the US or increase purchases of American goods. Both variants can damage the Chinese economy, which may weaken the yuan. For the first time, it was spoken about the measures to align the US-China trade balance in April 2018, and since then, the yuan has fallen by 7% against the US dollar. The increase in duties on Chinese goods shipped to the United States to 25% from 10% was scheduled on March 1. Yesterday, Donald Trump announced the possible extension of this period. Theoretically, the Chinese authorities may be interested in the weakening of the yuan in order to support the efficiency of local exporting companies. On Thursday, February 14, the foreign trade balance for January will come out in China, and on Friday, January 15 - inflation.

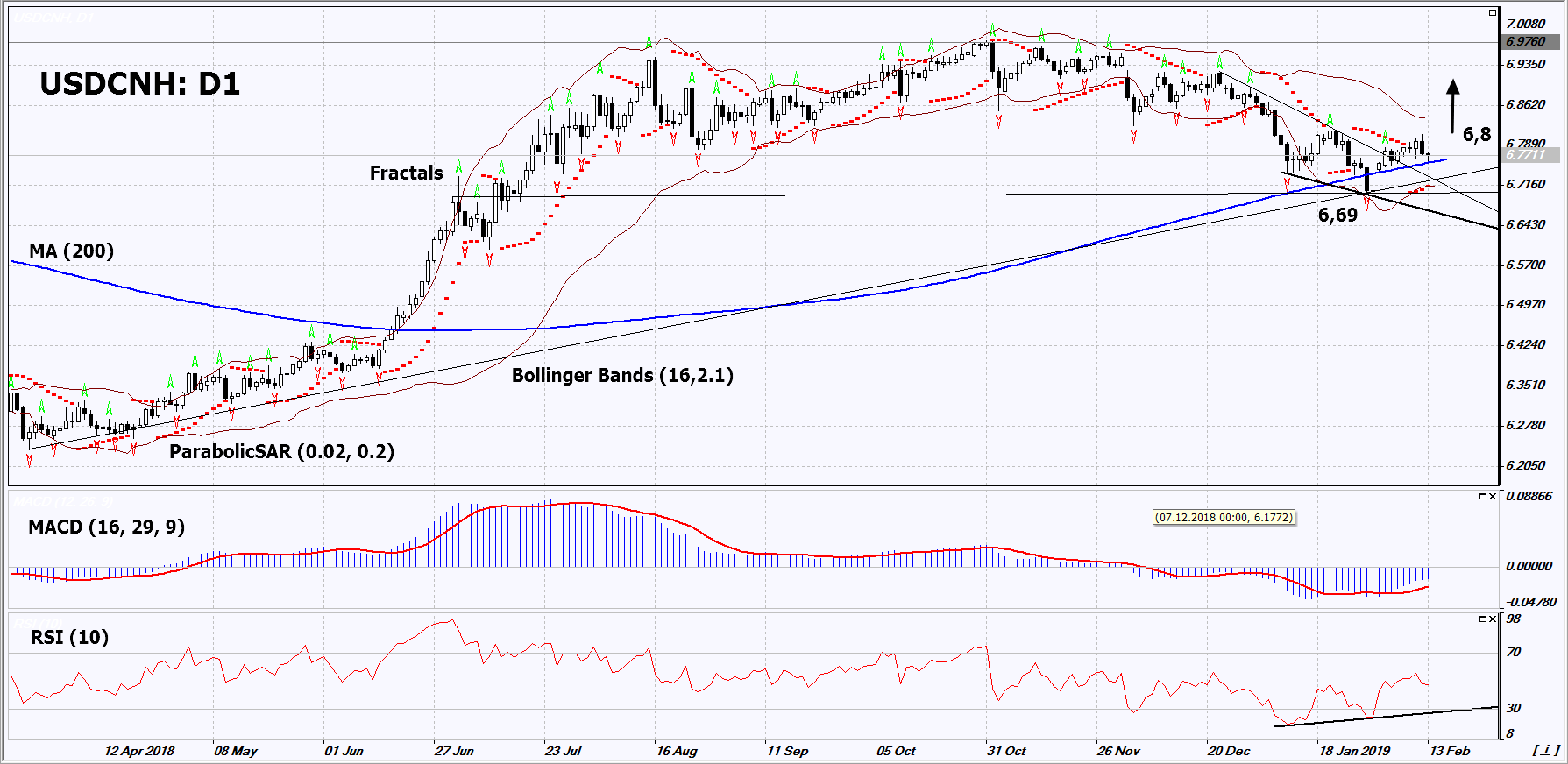

On the daily timeframe, USDCNH: D1 breached up the resistance line of the medium-term downtrend and is correcting towards the upper boundary of the long-term neutral range. A number of technical analysis indicators formed buy signals. The further price increase is possible in case of negative economic data in China and its concessions in the trade dispute with the US.

- The Parabolic indicator gives a bullish signal.

- The Bollinger bandshave narrowed, which indicates low volatility. Both Bollinger bands are titled upwards.

- The RSI indicator is near 50. It has formed a weak positive divergence.

- The MACD indicator gives a bullish signal.

The bullish momentum may develop in case USDCNH exceeds the two last fractal highs and the upper Bollinger band at 6.8. This level may serve as an entry point. The initial stop loss may be placed below the last fractal low, the Parabolic signal and the lower Bollinger band at 6.69. After opening the pending order, we shall move the stop to the next fractal low following the Bollinger and Parabolic signals. Thus, we are changing the potential profit/loss to the breakeven point. More risk-averse traders may switch to the 4-hour chart after the trade and place there a stop loss moving it in the direction of the trade. If the price meets the stop level (6.69) without reaching the order (6.8), we recommend to close the position: the market sustains internal changes that were not taken into account.

Summary of technical analysis

| Position | Buy |

| Buy stop | Above 6.8 |

| Stop loss | Below 6.69 |

Perhatian:

Tinjauan ini memiliki karakter informatif dan tutorial dan dipublikasikan secara gratis. Semua data, termasuk dalam Tinjauan, diterima dari sumber publik, diakui kurang lebih dapat diandalkan. Apalagi, tidak ada jaminan bahwa informasi yang ditunjukkan penuh dan tepat. tinjauan tidak diperbarui. Keseluruhan informasi dalam setiap tinjauan, termasuk pendapat, indikator, grafik dan hal lainnya, disediakan hanya untuk tujuan pengenalan dan bukan saran keuangan atau rekomendasi. Seluruh teks dan bagiannya, serta grafik tidak dapat dianggap sebagai tawaran untuk membuat kesepakatan dengan aset apa pun. Pasar IFC dan karyawannya dalam kondisi apapun tidak bertanggung jawab atas tindakan yang dilakukan oleh orang lain selama atau setelah membaca tinjauan.