- Analisis

- Analisis teknis

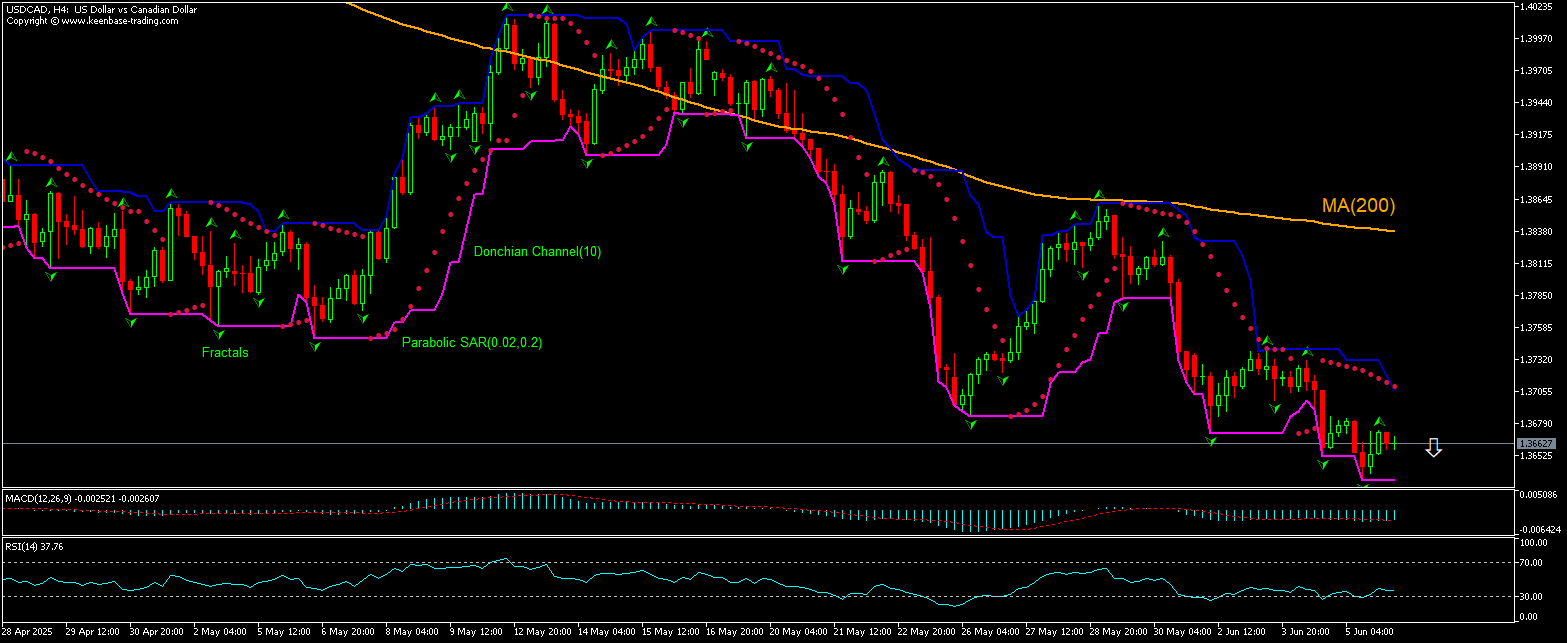

USD/CAD Analisis teknis - USD/CAD Jual beli: 2025-06-06

USD/CAD Technical Analysis Summary

Bawah 1.36315

Sell Stop

Atas 1.36811

Stop Loss

| Indicator | Signal |

| RSI | Neutral |

| MACD | Buy |

| Donchian Channel | Sell |

| MA(200) | Sell |

| Fractals | Sell |

| Parabolic SAR | Sell |

USD/CAD Chart Analysis

USD/CAD Analisis Teknis

The technical analysis of the USDCAD price chart on 4-hour timeframe shows USDCAD,H4 is retracing down under the 200-period moving average MA(200) following a test of MA(200) a week ago. We believe the bearish momentum will continue after the price breaches below the lower bound of the Donchian channel at 1.36315. A level below this can be used as an entry point for placing a pending order to sell. The stop loss can be placed above 1.36811. After placing the order, the stop loss is to be moved to the next fractal high indicator, following Parabolic signals. Thus, we are changing the expected profit/loss ratio to the breakeven point. If the price meets the stop loss level without reaching the order, we recommend cancelling the order: the market has undergone internal changes which were not taken into account.

Fundamental Analysis Forex - USD/CAD

Canada’s economic activity contraction was less than forecast. Will the USDCAD price continue retreating?

Canada’s economic activity contraction was less than forecast in May: the Richard Ivey School of Business reported the Ivey Purchasing Managers' Index (PMI) rose to 48.9 in May from 47.9 in April when an increase to 48.3 was expected. Readings above 50.0 indicate Canadian industry expansion, below indicate contraction. It was the second month that the economic activity shrank after a decline in January. Slower than forecast contraction in Canadian business activity is bullish for the Canadian dollar and bearish for USDCAD currency pair. However, earlier Statistics Canada reported Canada’s trade deficit rose to record high of CA$7.1 billion: merchandise exports dropped 10.8% over month to CA$60.4B in April, the lowest since June 2023, while imports fell 3.5% to CA$67.58 billion. Rising trade deficit is a downside risk for Canadian dollar and upside risk for USDCAD currency pair.

Explore our

Trading Conditions

- Spreads from 0.0 pip

- 30,000+ Trading Instruments

- Instant Execution

Ready to Trade?

Open Account Perhatian:

Tinjauan ini memiliki karakter informatif dan tutorial dan dipublikasikan secara gratis. Semua data, termasuk dalam Tinjauan, diterima dari sumber publik, diakui kurang lebih dapat diandalkan. Apalagi, tidak ada jaminan bahwa informasi yang ditunjukkan penuh dan tepat. tinjauan tidak diperbarui. Keseluruhan informasi dalam setiap tinjauan, termasuk pendapat, indikator, grafik dan hal lainnya, disediakan hanya untuk tujuan pengenalan dan bukan saran keuangan atau rekomendasi. Seluruh teks dan bagiannya, serta grafik tidak dapat dianggap sebagai tawaran untuk membuat kesepakatan dengan aset apa pun. Pasar IFC dan karyawannya dalam kondisi apapun tidak bertanggung jawab atas tindakan yang dilakukan oleh orang lain selama atau setelah membaca tinjauan.