- Analisis

- Analisis teknis

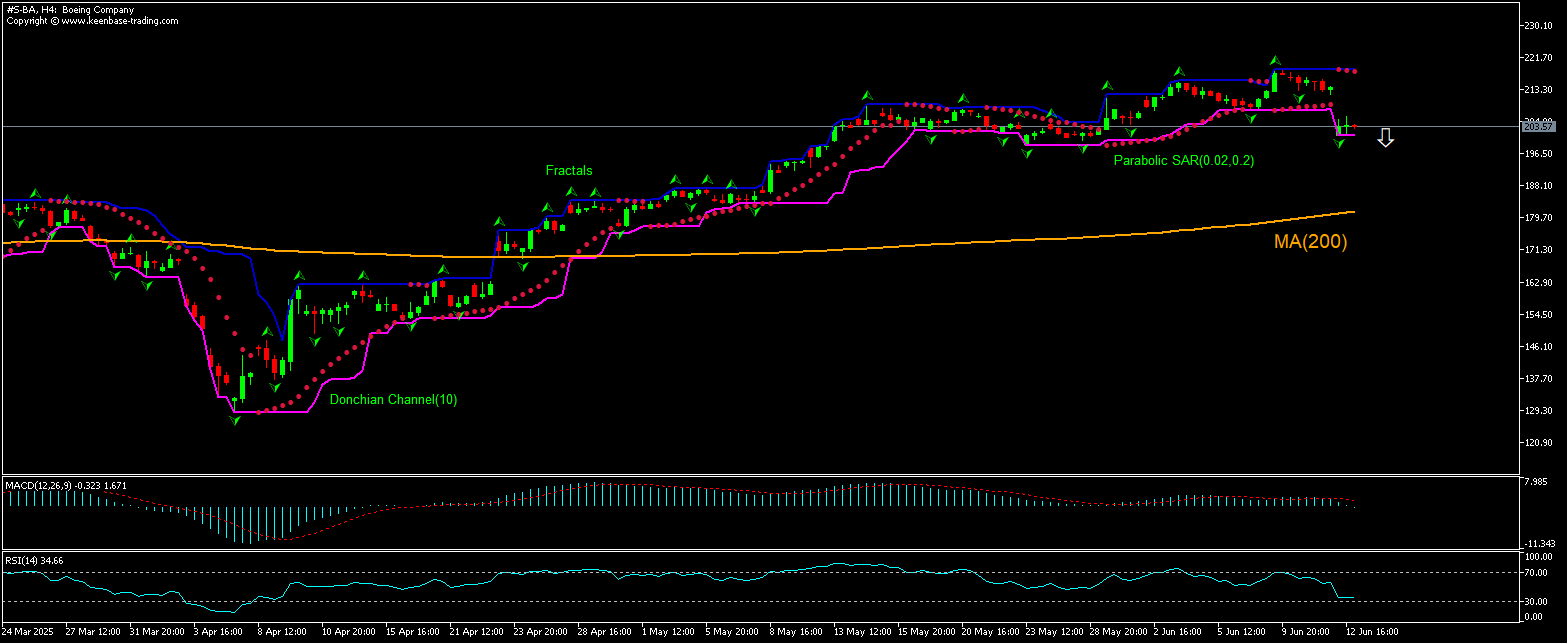

Boeing Analisis teknis - Boeing Jual beli: 2025-06-13

Boeing Technical Analysis Summary

Bawah 201.32

Sell Stop

Atas 214.17

Stop Loss

| Indicator | Signal |

| RSI | Neutral |

| MACD | Sell |

| Donchian Channel | Neutral |

| MA(200) | Buy |

| Fractals | Neutral |

| Parabolic SAR | Sell |

Boeing Chart Analysis

Boeing Analisis Teknis

The technical analysis of the Boeing stock price chart on 4-hour timeframe shows #S-BA,H4 is retracing down toward the 200-period moving average MA(200) after hitting 17-month high four sessions ago. We believe the bearish momentum will continue after the price breaches below the lower boundary of Donchian channel at 201.32. This level can be used as an entry point for placing a pending order to sell. The stop loss can be placed above 214.17. After placing the order, the stop loss is to be moved every day to the next fractal high indicator following Parabolic signals. Thus, we are changing the expected profit/loss ratio to the breakeven point. If the price meets the stop loss level (214.17) without reaching the order (201.32), we recommend cancelling the order: the market has undergone internal changes which were not taken into account.

Fundamental Analysis Saham - Boeing

Boeing CEO canceled his trip to the Paris Airshow next week after deadly Air India crash yesterday. Will the Boeing stock price retreating persist?

More than 240 people were killed when an Air India Boeing 787 jet bound for London crashed moments after taking off from the city of Ahmedabad. The plane crash killed over 240. Aircraft engine-maker GE Aerospace, whose engines were in the Boeing 787 plane, canceled an investor day planned on June 17, coinciding with the show, and said it would put a team together to go to India and analyze data from the crashed airplane. The plane that crashed was a Boeing 787-8 Dreamliner, it had been in service since 2014. Multiple analysts noted that the plane has a “very good” track record, with this being the first fatal crash. However, the 787 experienced several battery-related incidents soon after entering service in 2011. Commentary by aviation experts has focused on engine failure so far, with a multiple bird strike situation as a possibility. Analysts note the crash will likely negatively impact sentiment on the stock in the near term.

Explore our

Trading Conditions

- Spreads from 0.0 pip

- 30,000+ Trading Instruments

- Instant Execution

Ready to Trade?

Open Account Perhatian:

Tinjauan ini memiliki karakter informatif dan tutorial dan dipublikasikan secara gratis. Semua data, termasuk dalam Tinjauan, diterima dari sumber publik, diakui kurang lebih dapat diandalkan. Apalagi, tidak ada jaminan bahwa informasi yang ditunjukkan penuh dan tepat. tinjauan tidak diperbarui. Keseluruhan informasi dalam setiap tinjauan, termasuk pendapat, indikator, grafik dan hal lainnya, disediakan hanya untuk tujuan pengenalan dan bukan saran keuangan atau rekomendasi. Seluruh teks dan bagiannya, serta grafik tidak dapat dianggap sebagai tawaran untuk membuat kesepakatan dengan aset apa pun. Pasar IFC dan karyawannya dalam kondisi apapun tidak bertanggung jawab atas tindakan yang dilakukan oleh orang lain selama atau setelah membaca tinjauan.